JCPenney stores sold locations mark a watershed moment in the retailer’s post‑bankruptcy restructuring. In July 2025, JCPenney’s real estate trust sold 119 store properties—including three in Connecticut—to Boston‑based Onyx Partners for $947 million. This major deal is part of JCPenney’s long‑term plan to stabilize operations under new corporate guidance.

JCPenney Stores Sold Locations – What the Deal Includes

On July 29, 2025, Copper Property CTL Pass Through Trust announced the completion of a binding purchase agreement selling a portfolio of 119 JCPenney‑leased stores to Onyx Partners Ltd. for $947 million. Three of these facilities are located in Connecticut: at Manchester’s Shoppes at Buckland Hills, Westfarms Mall on the Farmington–West Hartford border, and Danbury Fair Mall. These stores will remain open, despite the sale of the property.

The sale reflects the trust’s obligation to liquidate assets by January 30, 2026, after more than 700 offers were considered. Onyx Partners stood out as the preferred buyer, with a national portfolio strategy spanning 47 states and over $2 billion in deals.

Strategic and Financial Implications

Operational leaseback: The agreement is structured as a long‑term triple‑net master lease. JCPenney retains operational control and ongoing responsibility for maintenance, while Onyx owns the real estate asset.

Balance sheet relief: The infusion of nearly $1 billion in coins facilitates satisfying creditor duties from JCPenney’s 2020 Chapter 11 financial disaster.

Stable day‑to‑day experience: Because the stores remain open under lease, employees and customers are unlikely to see immediate disruption, even amid broader restructuring.

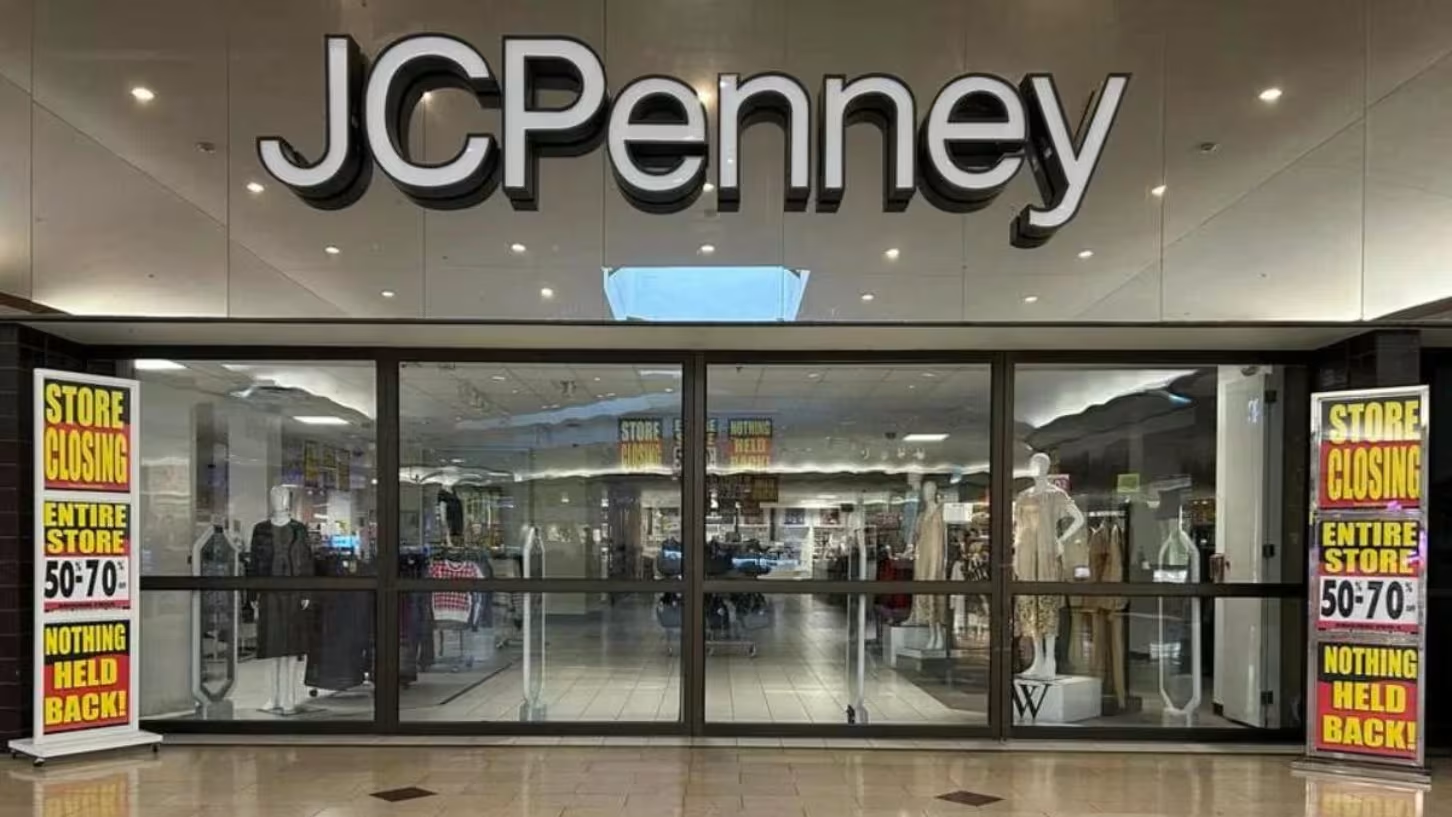

Background: Store Closures and Catalyst Brands

Earlier in 2025, JCPenney introduced the closure of eight legacy stores throughout the U.S., including websites in California, Colorado, Idaho, Kansas, New Hampshire, North Carolina, West Virginia, and Maryland. All were shuttered by May 25, 2025, often tied to expiring mall leases or poor foot traffic.

In January 2025, JCPenney merged with SPARC Group to create Catalyst Brands, bringing together Aeropostale, Brooks Brothers, Eddie Bauer, Lucky Brand, Nautica, and JCPenney under one umbrella.

The intention: streamline operations, leverage synergies, and reinvigorate these legacy manufacturers.

The store closures were officially separate from Catalyst’s strategic launch, though many analysts view them as part of a wholesale shift in business approach—moving away from traditional malls toward digital-first and brand-collaborative models.

What Customers and Communities Should Know

Connecticut stores will continue operating under the new ownership, preserving jobs and service continuity for customers.

Store closures elsewhere, notably on May 25, 2025, led to final clearance events in seven malls across multiple states, signaling JCPenney’s ongoing consolidation strategy.

Broader Retail Landscape and Consumer Trends

JCPenney’s ongoing downsizing reflects broader macro shifts in retail:

- Declining mall traffic and competition from online retailers have undercut traditional department store viability.

- Chains such as Macy’s, Kohl’s, and Forever 21 have also announced significant store closures or restructuring, aligning with industry‑wide retrenchment strategies.

- By restructuring through its Catalyst Brands strategy and selling real estate assets, JCPenney is attempting to reduce debt and pivot toward hybrid retail models blending physical and digital channels.

Future Outlook

JCPenney now operates around 649 stores across 49 U.S. states and Puerto Rico under the Catalyst Brands umbrella, but with a notably leaner footprint than before.

Onyx Partners will, in all likelihood, manage the actual property with a steady profits view—collecting rent under the net hire while permitting JCPenney to hold operating. This separation may additionally offer both stability and versatility for JCPenney as it refocuses on brand revitalization and omnichannel boom.

Meanwhile, Catalyst Brands aims to generate over $9 billion in revenue by integrating consumer favorites from its portfolio and investing in its private labels—Arizona, Stafford, and Liz Claiborne—alongside house-branded apparel, home goods, and beauty offerings.